What are the parts of Medicare?

Part A (Hospital Insurance)

Helps cover:

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care

Part B (Medical Insurance)

Helps cover:

- Services from doctors and other health care providers

- Outpatient care

- Home health care

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

Helps cover the cost of prescription drugs (including many

recommended shots or vaccines).

Plans that offer Medicare drug coverage (Part D) are run by

private insurance companies that follow rules set by Medicare

Your Medicare options

When you first sign up for Medicare, and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare:

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

- To help pay your out-of-pocket costs in Original Medicare (like your 20% coinsurance), you can also shop for and buy supplemental coverage

- Part A

- Part B

You can also add:

- Supplemental coverage

This includes Medicare Supplement Insurance(Medigap).

Medicare Advantage (also known as Part C)

- Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

- In most cases, you can only use doctors who are in the plan’s network.

- In many cases, you may need to get approval from your plan before it covers certain drugs or services.

- Plans may have lower out-of-pocket costs than Original Medicare.

- Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

- Part A

- Part B

Most plans include:

- Part D

- Some extra benefits

Some plans also include:

- Lower out-of-pocket costs

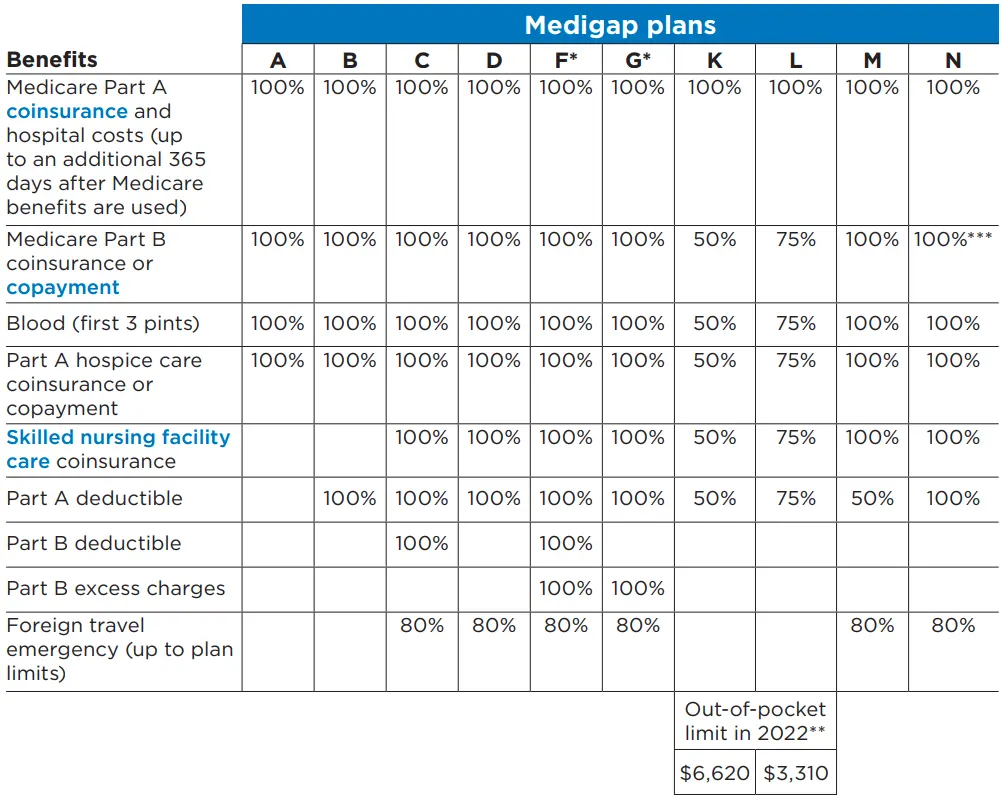

How do I compare Medigap plans?

The chart below shows basic information about the different benefits that Medicare Supplement Insurance (Medigap) plans cover for 2022. If a percentage appears, the Medigap plan covers that percentage of the benefit, and you’re responsible for the rest. Out-of-pocket costs (like deductibles) might change for 2023.

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,490 in 2022 before your policy pays anything. (You can’t buy Plans C and F if you were new to Medicare on or after January 1, 2020. See previous page for more information.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($233 in 2022), the Medigap plan pays 100% of covered services for the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance. You must pay a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.